Renko Bars Indikator

Jul 12, 2017 The ORIGINAL NinjaTrader Mean Renko Bars along with a Custom Renko Bar Marker. Two Price Action indicators for the Price of One! FAST, ACCURATE Simply the Best Renko Bars for Day Trading! The Mean Renko Bars are a totally re-engineered and improved variant of the traditional Renko bar. Using the Renko indicator. 2.2.2 Multiple Renko blocks per chart candle. The Renko bar indicator draws Renko blocks on a normal MT4 time-based chart.

Share Tweet Google Plus Share Email Whatsapp Print Renko Charts Trading Strategy is one of the many different chart types that are available to plot the price action. Other chart types include line chart, OHLC bar chart, candlestick chart, point and figure to name a few.

• After the NVIDIA 3DTV Play Activation Utility has been installed, it will prompt you to continue using 3DTV Play software in trial mode or enter a serial number. Please select 'Enter a Serial Number' and enter in the serial number found in the email you received from service@store.nvidia.com. Nvidia 3dtv play activator trial reset como. NOTE: The Activation Utility will also check if a 3D TV is connected, but a 3D TV is not Nvidia 3dtv play trial reset Nvidia 3d tv download. Download the 3DTV Play Activation Utility. This utility will authorize your computer to use 3DTV Play. Install the 3DTV Play Activation Utility using the wizard-based process.

The uniqueness of Renko charts however is the fact that it is purely price based and does not factor in time, as with the more commonly used chart types (Line, Bar, ). The Renko charts trading strategy gives traders a different perspective to and therefore even the methodology involved can differ when compared to the regular trading strategies using one of the more conventional chart types. What is Renko Charts Trading Strategy? Thank you for your readership.  We are truly grateful! Hope that you like the strategies that we share. If you like the strategies here, you will absolutely love our latest strategy.

We are truly grateful! Hope that you like the strategies that we share. If you like the strategies here, you will absolutely love our latest strategy.

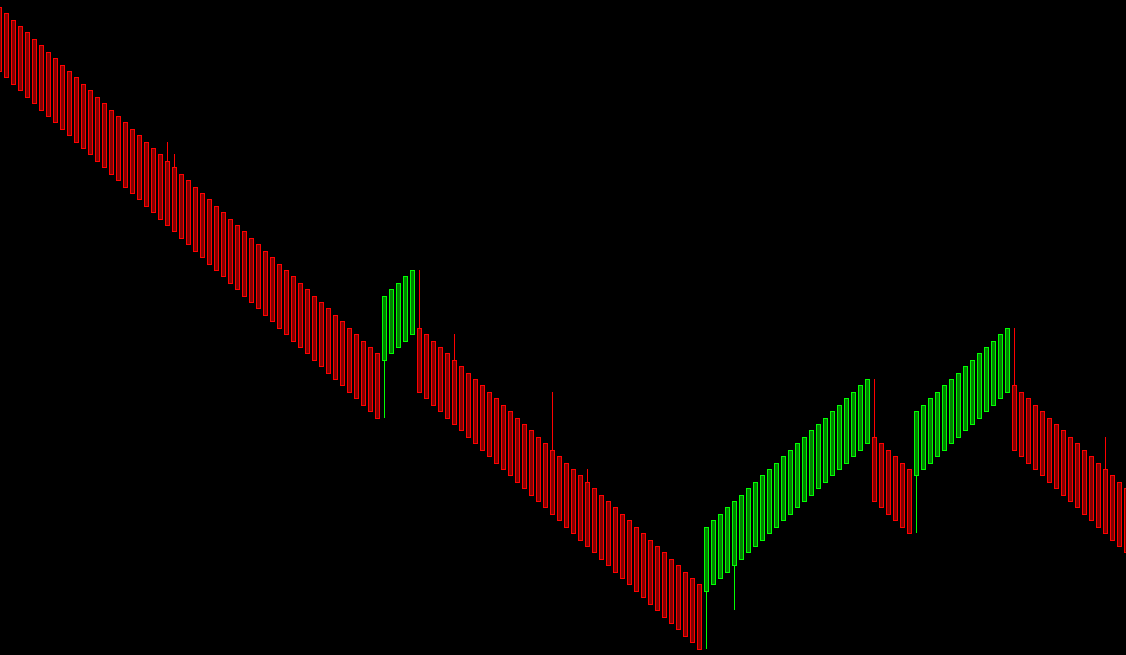

The aim of Morningpips is to finish trading by the morning. Simple as that. Check it out! Renko charts were developed in Japan and the term ‘Renko’ comes from the Japanese word ‘Renga’ or ‘Brick’. Renko charts are easy to identify based on the ‘bricks’ that are formed with each brick representing a fixed amount of pips or points for the instrument for which it is being used. For example, a 20 pip Renko chart would mean that a new brick is formed only when price moves 20 pips above or below the previous price. Renko charts do not consider when (the time factor) price moves and therefore depicts price action in its purest form.

Ichimoku and Price Action There are many trading strategies that can be developed using Renko charts both indicator based or price action based. One of the more common approaches to trading with Renko charts is the price trends that are visually easy to identify and therefore trend trading is one of the more common ways to trade with Renko charts. The most commonly used indicator that comes to mind when using a trend following strategy is the. Applying the Ichimoku to the Renko charts but only using the Ichimoku cloud and the lagging span can offer a fairly simple trend following strategy.

Tweets • Reversal Trend Strategy EURUSD – 8th March 2019 • Breakout Trading Signal CADJPY – 28th Feb 2019 Free Forex Trading Signal • Breakout Trading Signal EURNZD – 26th Feb 2019 Free Forex Trading Signal • London DayBreak Strategy GBPCAD – 25th Feb 2019 Free Forex Trading Signal • Counter Trend Strategy USDCAD – 25th Feb 2019 Free Forex Trading Signal • Trend Trading Signals EURAUD – 25th Feb 2019 Free Forex Trading Signal • London DayBreak Strategy XAUUSD – 22nd Feb 2019 Free Forex Trading Signal • Counter Trend Strategy GBPUSD – 22nd Feb 2019 Free Forex Trading Signal. Disclaimer There's always a disclaimer in websites. But instead of having the usual legal terms drafted by lawyers, we are just gonna put this in plain English as we like to be casual. You must know that past performance and future performance are not the same thing. Past performance is a track record of what has happened in the past and future performance might be very different from past performance.

Anything that has done well in the past may not do well in future, who knows, right? You have to use common sense sometimes and know what's real and what's clearly a scam.

To our best ability, we put out only legit products and services on our website. You, and you only, have the power to make any investment decision. If you cannot take risk, sadly, any form of investing or trading is not for you. The last thing we want to hear are complains or whining as it just reflects badly on you. You need to understand the risk in Forex and the Financial Market before getting involved.